http://www.zerohedge.com/article/trading-over-counter-gold-and-silver-be-illegal-beginning-july-15

Has anyone else heard about this?

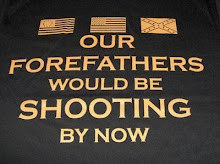

Does anyone have a clue if it "means what I think it means"? An honest opinion without all the Government Spin and Media Froo-froo to paint a bluer sky for us Mundano?

I am looking at the Frank-Dodd Act and what I am reading is ominous even in layman terms. Of course, more regulatory BS from that Cesspool on the hill. BUT what does it mean to the common man on the street? I have some ideas but want to reach out to others that may have more of a finger in the pie than myself.

If it does, I may have to make a serious dent in my finances here pretty quickly.

OTC without paperwork baby, no trails. The only way to fly in our day and age.

Anyway, if you have something on this, please chime in, OR, if you want to remain anonymous, feel free to use the email as posted.

Subscribe to:

Post Comments (Atom)

13 comments:

Layman that I am, it seems that they are putting a stop to speculation on precious metal trading. Which in terms of halting the creation of artificial bubbles is a good thing.

Now I could be wrong, but it seems that it only means that you must actually deliver the goods, instead of just a piece of paper promising those same goods.

It could very well cause big problems with the price of gold and silver, as these are heavily leveraged. We could see a giant collapse in those areas.

Over all this practice has been bad for us on the bottom end of the scale, by causing artificial inflation of everything else.

Hopefully they will consider doing the same with oil.

Think about it. Speculation is actually what caused the housing collapse along with ARM's.

Yuppie scum need to stop sucking the life out of all of us.

Course what do I know ?

My world is that if I buy something, I get the actual goods.

Not so much for making profits but for my use.

Though I trust the government about as much as a lion in a meat market, Spud might be right there. I hope so anyways...

Thats why I posted this. I see a different point of view now and it may be just what you said. Of course the people that will be negatively affected by this are squawking loudly. That was part of what had me worried.

The other side of this, seeing how there is a deadline in place, I see some serious manipulation UP TO that point then a collapse. (this is what I told the person that sent me the link in an Email.) Maybe I should wait UNTIL that date then do my 'grabbing up'. Of course, everything I do is in physical and I do my damnedest to keep paperwork simple. (FRNs across the counter and no receipts thank you very much out the door.)

I try to purchase all things with the nasty paper work, gold, silver and even Guns. The less the Feds know about me the better.

whoops I meant "without the nasty paperwork" sorry.

It will without a doubt crash the market in both. More so the silver as I hear that paper far exceeds supply.

Hold on to your shorts folks...

Just hope I make it back home from Idaho before anything goes down.

Bad as it is, sometimes regulation can be good. We know just how greedy some folks can be if they are not somewhat controlled

Well, According to everything I have been reading, you have until July 15th for this to happen. There may be a good rollercoaster ride into that date but I don't see 'Collapse' prior to it.

Even then, I see only the pebble that leads to the landslide if at all. Similar to what happened under all the other bubbles. Rocky roads then smoothing out to a lower state of mediocrity.

Ya me too, got time.

Having family is all that matters.

Sides I got 150 oz's of junk silver stashed up there. In a rollaway Snap-on top-n-bottom box. Full of tools too. Might have to pick thru em again. Or maybe give em all to my son that lives there, sans silver course.

Patrick says...

Here you go, Dio...

http://dont-tread-on.me/rumor-no-forex-trading-of-gold-and-silver-in-us/

http://dont-tread-on.me/consequences-of-the-dobb-frank-act/

Thank you very much Patrick. Welcome to site.

Spud. Heck, I wouldn't part with Snap-on Tools no matter what. The old ones are the best. Pretty much anything made after 98 is the equivalent of Craftsman but everything prior to that is gold, handles like silk and will break only if you are REALLY trying to break it. (and I mean TRYING!)

Patrick says...

Thank you...

.....Been reading for a short time now and thought I could help on this question; I spend a lot of energy staying on top of this whack job economy...

Patrick: The links were very informative, And very much appreciated. It's going to be an interesting show here soon, No?

I especially liked the analogy of "tax Farms" as countries. How apt!

"It's going to be an interesting show here soon, No?"

Patrick says...

hehehe...

.....I'm quite certain we don't know the half of it; the "merchants" are wailing as we speak... ;o)

Post a Comment