Just received a bill from the insurance company for my dentist visit.

I get a little ticked off at the insurance companies at times like this. Seems that I am responsible for a majority of the costs, while the insurance company is off the hook for all but 20%. This, after I have been paying into the program for 6 months.

I am going to pay this one. Technically, I already have but the accountants would say otherwise.

No more though. I have a follow up with another dentist in a couple of weeks. I am going to ask, right off the bat, how much the services will cost me if I pay cash and not use the insurance at all. The last time I did this, I saved about $1000 up front, had no headaches with 'bills', and everyone was happy with the end result. If he tells me that it will cost the same or less, I am going to pay cash, call the insurance company and cancel my policy. I will save more in the long run that way just by NOT paying them for the headaches. (if you have never tried this, I recommend it. Most Docs and DDS's are willing to get around the system since it cuts down on trying to chase down the money.)

This is exactly how I was set up with my Doc in Cincy (and I am trying to find one here that is willing to work the same way) and it saved me tons. Hell, just an office visit to him was only $25 and that was less than my co-pay with insurance. If I needed a prescription, he would see what he had in samples first before writing anything and if he had to write one, he would make it for a generic that cost tons less.(and I only needed that once)

Insurance is not exactly all its cracked up to be. And the amounts of money that get tossed around probably don't add up in the books at the end of the day.

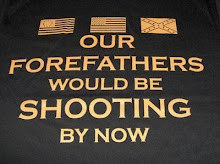

And of course, the Federal Government has had a hand in the destruction of the medical field for years. (that whole medicaid/medicare scam really sets off the scales of the true costs of things)

Granted, if something bad really happens (IE cancer or major accident) I am screwed. The only way I can pay for any hospital treatments is with the insurance. But routine stuff is usually not too bad.

Does anyone know of an insurance company that specializes in ONLY catastrophic health insurance?

Subscribe to:

Post Comments (Atom)

2 comments:

Dental care (along with maternity care) is not random enough to actually fit within the insurance model of distribution of unexpected costs. These types of insurance programs have to work as some sort of "forced savings" program for them to work.

When I broke my ankle years ago, I was "between insurance policies". In other words, I was in a 90 day waiting period of a new job. They managed to finagle early coverage for me. Anyhoo, the cash price for my surgery, etc. was 8 grand. But after I got insured, the tab rose to 20 grand. Imagine that...

Post a Comment